Mission-aligned investing presents a compelling opportunity for philanthropic organizations to reimagine how they use their financial resources to affect change. All of the institution’s capital is harmonized in service of its mission — a total-enterprise approach to impact. Yet, such an approach is relatively novel and still often met with skepticism or confusion.

Our report addresses this skepticism by demonstrating the potential for mission-aligned investing to enhance mission impact while continuing to meet financial goals. We are also candid about where we see gaps and shortcomings in the marketplace. Although our research focused on mission-aligned investing practices among outsourced chief investment officers (OCIOs), we believe these findings will be of interest to any institutional investor — including those who work with nondiscretionary investment advisors and/or in-house investment teams.

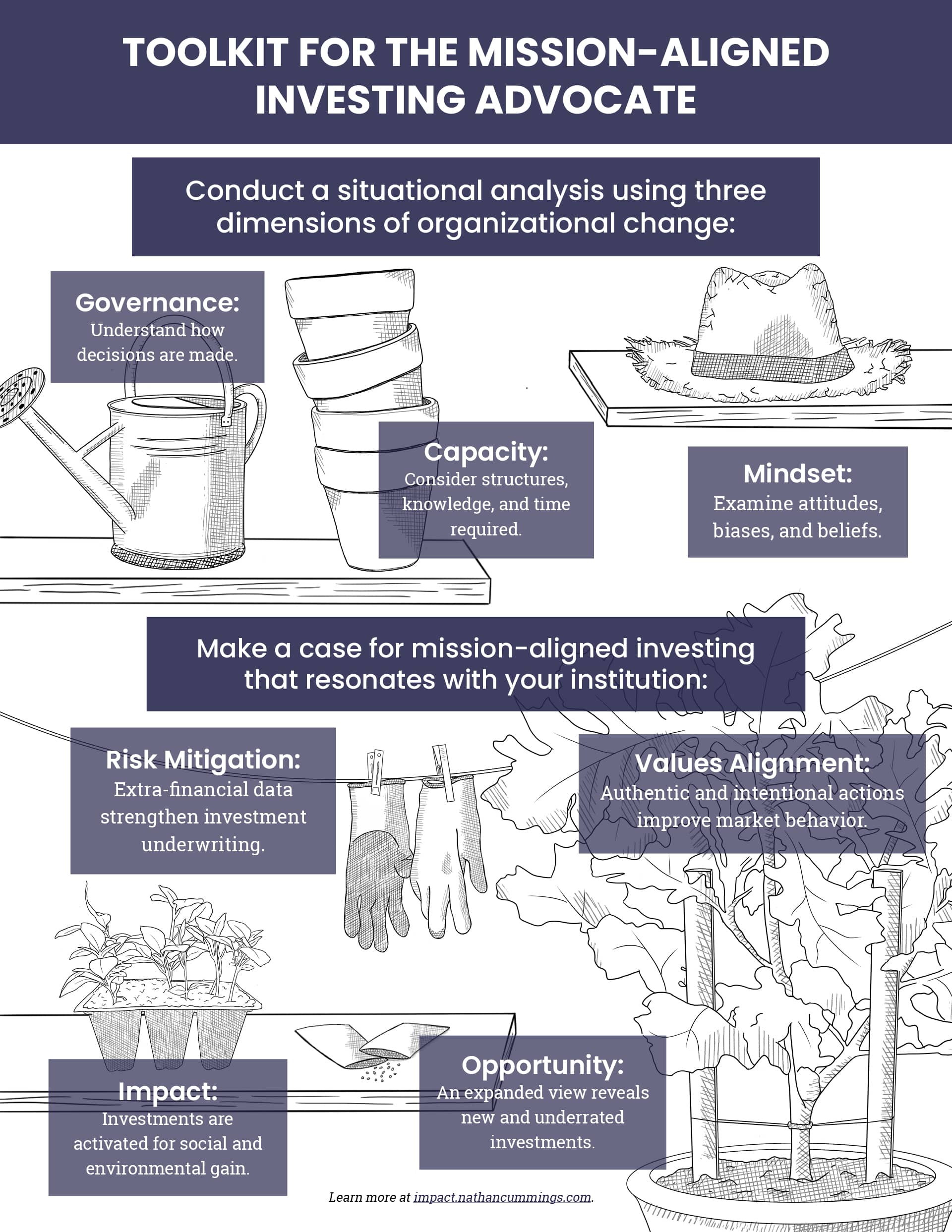

Our toolkit provides mission-aligned investing advocates with resources that were developed based on our experience of aligning our $450 million endowment with our mission over the past three years. It likely mirrors the experiences of others as well. The toolkit consists of a framework to conduct a situational analysis at your organization and a four-pillar approach to make the case for mission-aligned investing. We provide some working definitions for clarity, but we do not focus on them. We recognize that each institution is unique. We offer a construct that can be adapted to your circumstances.

Toolkit for the Mission-

Aligned Investing Advocate

Working Definitions

We define mission-aligned investing as a range of complementary practices that help an institution achieve its financial goals, produce positive and mission-relevant impacts in the world, and promote greater alignment with institutional values and priorities. We view the sum of these contributions as a significant enhancement of the Board of Directors’ fiduciary oversight.

Mission-aligned investing practices include: negative screening; integrating environmental, social, and governance (ESG) data, including diversity, equity, and inclusion (DEI) data; emphasizing diverse-led funds and emerging managers; active ownership; socially responsible investing (SRI); mission-related investments (MRI); program-related investments (PRI); and impact investing. For the purpose of this report, the distinctions between these strategies are not important. Rather, we focus on how they overlap and work together to enable a total-enterprise approach to impact.

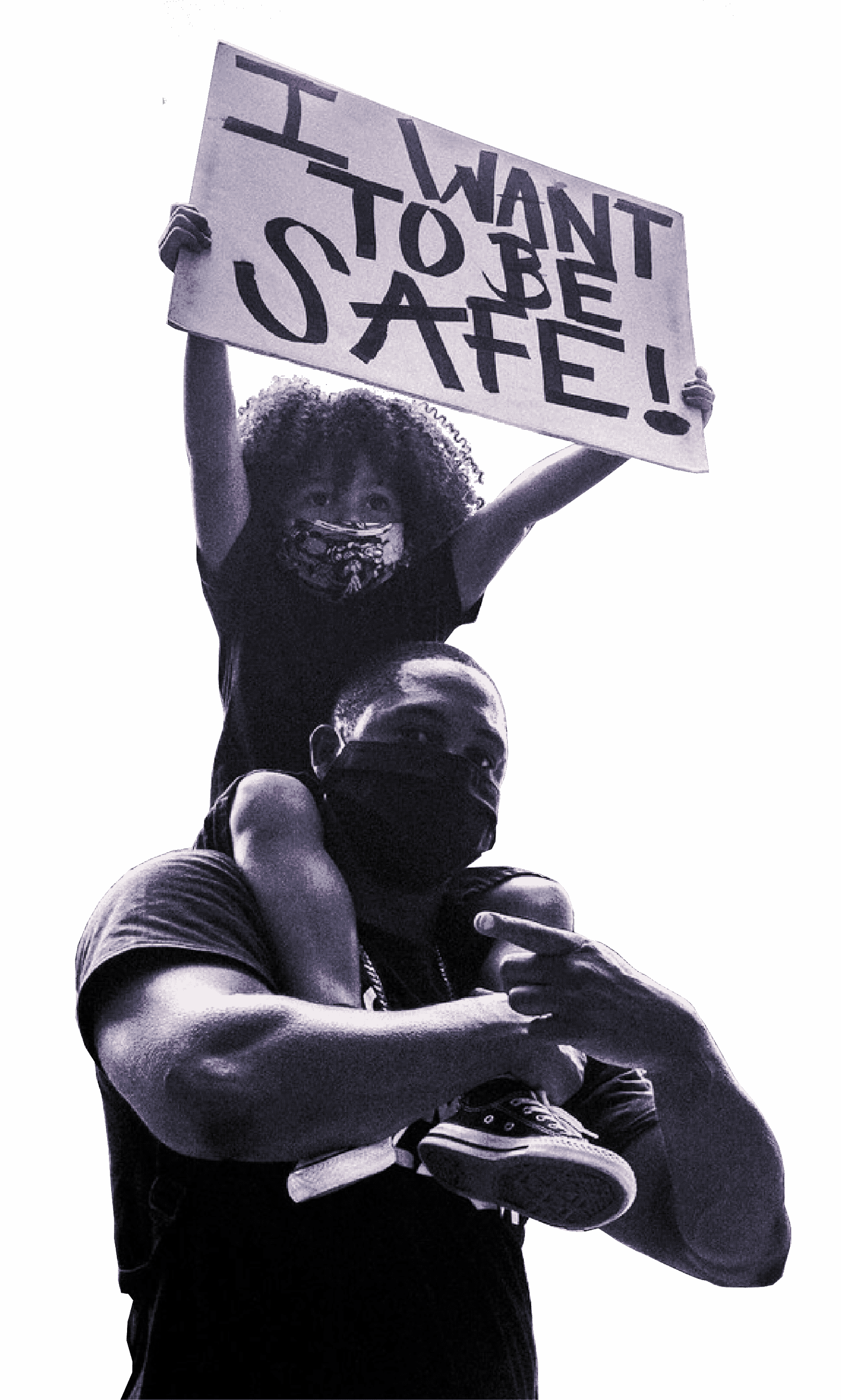

We refer to diverse-led funds throughout this report. Our experience has taught us the importance of establishing a clear definition and benchmarks for diversity. We define diverse-led funds as those that are majority-owned by women and/or people of color. We acknowledge that ownership is not the only relevant metric for DEI. We also recognize that our commitment to inclusivity will need to be expansive to include other communities and identities beyond women and people of color. However, adopting this imperfect definition allowed us to get started, which was critical.

Dimensions of Organizational Change

A clear understanding of governance – how decisions are made – is where successful change processes begin. Like many small- to medium-sized foundations, we delegate our investment decisions to an OCIO. This outsourced firm has the authority to make most investment decisions on our behalf (e.g., to hire or fire investment managers). However, those decisions are governed by an investment policy statement (IPS) that is the responsibility of the Investment Committee and, ultimately, the Board of Directors. The fiduciary duties of the Board of Directors include ensuring that all activities advance the organization’s mission. Incorporating mission-aligned investing within the IPS is consistent with this objective.

Next, consider capacity – what structures, knowledge, and time will be required to do the work well. This is idiosyncratic to each institution and requires a candid assessment of whether the current mix of internal and external capacities aligns with aspirations. There is no doubt that a commitment to mission-aligned investing will require scaling organizational bandwidth and flexing new muscles. As mentioned, one capacity we emphasize in this report is mission-aligned investing among OCIOs in the US. Our findings are also relevant to a broad audience of institutional investors.

Lastly, mindset – individual and collective attitudes, biases, and beliefs – may be the most nuanced and important dimension of change. There is a persistent myth of tradeoff in impact investing — the notion that a unit of social impact requires more risk or sacrifices potential returns. This has not been our experience, nor do the data or our research support this position. Nevertheless, this misperception remains common among investors. We recommend establishing an intentional learning agenda to engage all decision makers and overcome such obstacles. We describe how such a process enabled courageous transformation within our organization later in the report.

Making the Case

There are four reasons every institution should consider a more intentional and mission-aligned approach to investing. Each is credible and compelling, yet they are not mutually exclusive. We encourage you to determine which reasons are most relevant to your organization and where there might be overlap. We endeavor to operate at the intersection of all four, but we acknowledge that some investments will emphasize a subset of these pillars.

Risk mitigation: There is growing consensus among investors that incorporating extra-financial data, such as ESG considerations, makes an investing process stronger. ESG factors can be material to the short- and long-term performance of a company. Therefore, the ability to identify and quantify such risk exposure is an enhancement of the traditional investing process, providing a new perspective on the challenges and opportunities faced by the companies in your portfolio. We believe that applying this enhanced risk lens will ultimately yield more resilient returns for investors.

Opportunity: The best investors are adept at identifying opportunities and “hidden gems” that most of the market misvalues or overlooks. This often means analyzing demographic, social, and/or economic trends to find mispricing and other inefficiencies in pursuit of alpha – financial outperformance above the markets. We see the incorporation of an environmental, social, and governance lens as fundamentally similar. One market inefficiency we are keenly examining is underinvestment in funds managed by women and/or people of color – over 98 percent of a $69 trillion universe of funds has been invested in funds managed by white men. These data suggest there are great reservoirs of talent that are not receiving commensurate investment, which presents an opportunity to outperform.

Impact: The notion that businesses have an enormous impact on society is hardly controversial. In 2021, businesses are poised to create 6.7 million jobs, emit thirty-four billion tons of pollution, and create and distribute vaccines that will save millions of lives. Corporate impacts are as vast as they are varied. Until recently, we lacked the tools to measure or manage such impacts within an investment portfolio.

Our desire to optimize portfolio impact is rooted in our belief that our society’s enormous challenges will not be solved by philanthropy alone. Consider, for example, that the United Nations estimates a funding gap of $2.5 trillion each year over the next decade to achieve the sustainable development goals and avert the worst effects of climate change. The combined resources of all private foundations in the US amount to $1 trillion by contrast — a great deal of wealth but far short of what is required. Impact investing creates a powerful convergence of public, private, and philanthropic interests. It enables philanthropic organizations to leverage private sector resources in service of their missions.

Values alignment: It is said that private foundations are investors who award grants on the side. This is not intended to understate the importance of grantmaking — rather, it reminds us that our investment team deploys the vast majority of our financial resources. Such decisions have been siloed, sometimes barricaded, from the rest of the organization in the past. While investors may aspire for their decisions to be objective and data-driven, no decision is values-neutral. Therefore, the task is to raise the visibility of these values and examine the underlying assumptions beneath them.

An increasing number of investors seek alignment between their investments and their institutional and/or personal values. They see their investments as a means to communicate with corporations, change behaviors, or repair relationships with other stakeholders. Perhaps the greatest movement toward alignment will result from the intergenerational wealth transfer now underway. Baby boomers are expected to transfer $30 trillion in wealth to their heirs by 2030, and that number may exceed seventy trillion by 2060. This seismic shift has created a race among large, institutional asset managers to create products to meet the new demand — spurring progress and innovation but raising the risk of inauthentic or superficial treatment. Values-driven investors will need more transparent and consistent forms of impact measurement to avoid so-called “impact washing.”

RESEARCH HIGHLIGHTS

In 2020, we surveyed 115 OCIOs, ultimately engaging eighteen leading firms in a conversation to inform the next chapter of our approach to mission-aligned investing. We studied the relationship between impact and performance. We deepened our understanding of best practices among these firms and gaps and opportunities for improvement. Here are the highlights of our research:

- You don’t need to sacrifice financial returns to cultivate impact. We observed no negative correlation between the portion of a firm’s assets dedicated to impact and the firm’s performance relative to peers.

- Traditional measures of capacity are stifling growth and innovation. Many of the most innovative, impact-oriented firms tended to be younger and have fewer assets under management, which may disadvantage them in a traditional search. This trend was particularly evident among Black-owned firms.

- Diverse, inclusive portfolios start with purpose and measurement. Firms with a clear mandate and an intentional approach to measuring fund manager diversity exhibited less racial or gender bias when selecting funds for their clients.

- Advisors are often barriers between investors’ values and their investments. Firms frequently touted their ability to engage with fund managers and leverage professional relationships, but most avoid doing so around matters of diversity and inclusion, ESG performance, or impact.

- Impact measurement and management (IMM) is still a work in progress. Most firms employ a proprietary approach to ESG and impact measurement, attempting to aggregate dissimilar data from their funds. We found none that subject their impact reporting to external audit or review.

- Even among impact investors, too few focus on social, racial, or economic justice. Many firms offer well-defined strategies for incorporating ESG data into their investing approach, but few have integrated measures for advancing social, racial, or economic justice.

Our research was by no means exhaustive, and there were innovative firms we did not hear from in our process. Rather, we sought to examine the contours and direction of a sea change underway. We believe this work stands as a credible snapshot of an industry that is transforming. There is capacity among advisors and OCIOs to support mission-aligned investing, and that capacity is rapidly evolving. Three years into our own transformation, and after nine months of research, we are more convinced than ever: this can be done.